Fixed variable and semi-variable overhead. 49 Describe How Companies Use Variance Analysis.

Variance Analysis Learn How To Calculate And Analyze Variances

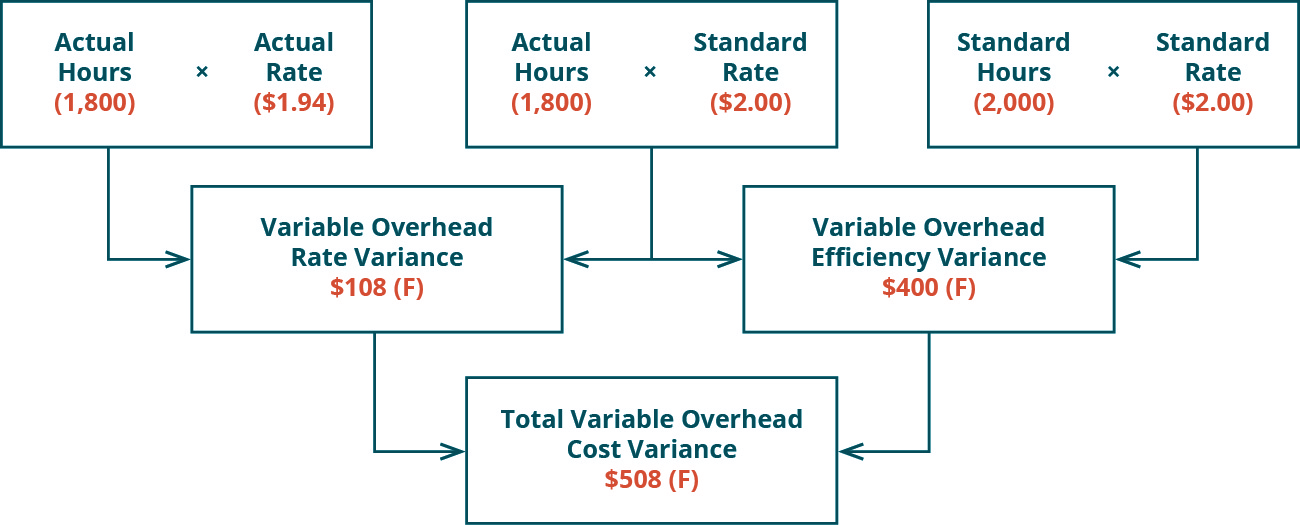

The variable overhead rate variance is calculated as 1800 194 1800 200 108 or 108 favorable.

. Calculate the amount of the overhead variance and allocate the variance to work-in-progress finished goods and cost of goods sold. Actual hours worked x Actual overhead rate - standard overhead rate Variable overhead spending variance. The variable overhead spending variance VOSV measures the aggregate effect of differences in the actual variable overhead rate and the standard variable overhead rate.

A lower overhead rate indicates efficiency and more profits. Explain the meaning of the volume variance to the manager of Laughlin. Actual overhead is 1450000.

Actual output x Standard fixed overhead rate Actual fixed overhead. Fixed costs variable costs or semi-variable costs. Fixed Overhead Variance will be 1600 Adverse Calculation of Sales Variance Sales Variance BQ BP AQ AP 250056 270055 Sales Variance will be 850 Adverse Relevance and Uses It can be said that variance analysis involves the isolation of different causes for variation in budgeted when compared with actual outcomes.

VOSV AVOR. The starting point is the determination of standards against which to compare actual results. Actual Quantity x Standard Rate.

VFOH spending variance and VFOH efficiency variance. Actual Quantity x Actual Rate. Therefore i Spending variance Variable spending variance Fixed spending budget variance ii Efficiency variance Variable efficiency variance iii Volume variance Fixed volume variance C Four-way Variance Analysis.

Variable overhead spending variance Actual costs AH SR Variable overhead spending varianceActual costs AHSR100000 189005 5500 unfavorable As with direct materials and direct labor variances all positive variances are unfavorable and all negative variances are favorable. Learn variance analysis step by step in CFIs Budgeting and Forecasting course. We need to determine what percentage of the applied overhead is in each of the accounts.

No matter how your business is performing or what kinds of crazy market forces are at work youll pay the same amount for rent every single month. Actual output x Standard variable overhead rate Actual variable overhead. Calculate the fixed overhead spending and volume variances.

Compute the direct labor rate and labor efficient 3. 53 Explain and Compute Equivalent Units and Total Cost of Production in an Initial Processing. 1000 Adverse a Expenditure Variance.

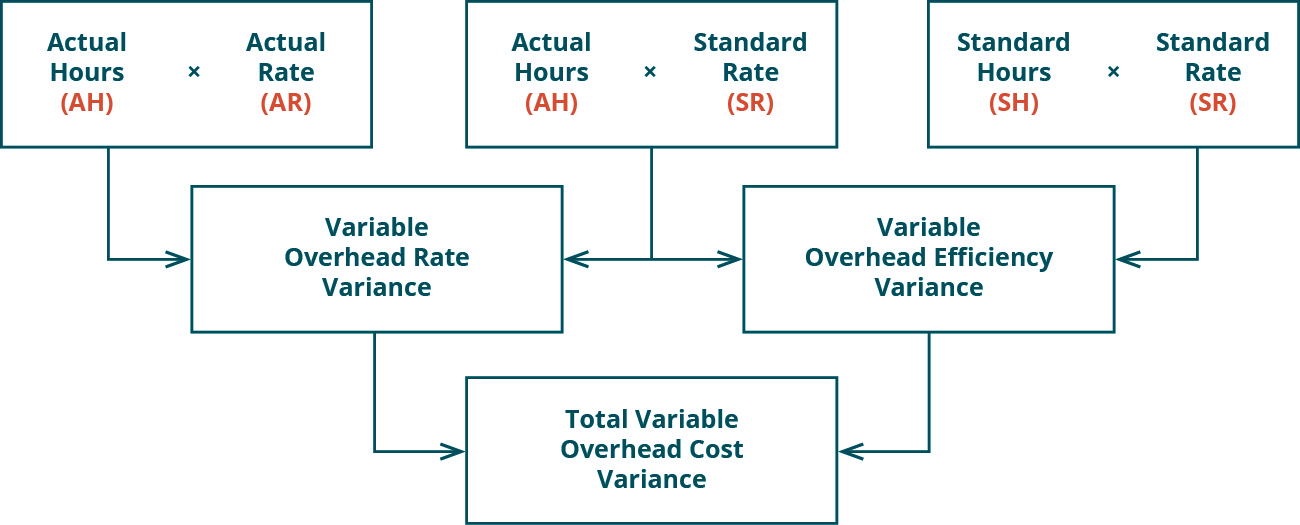

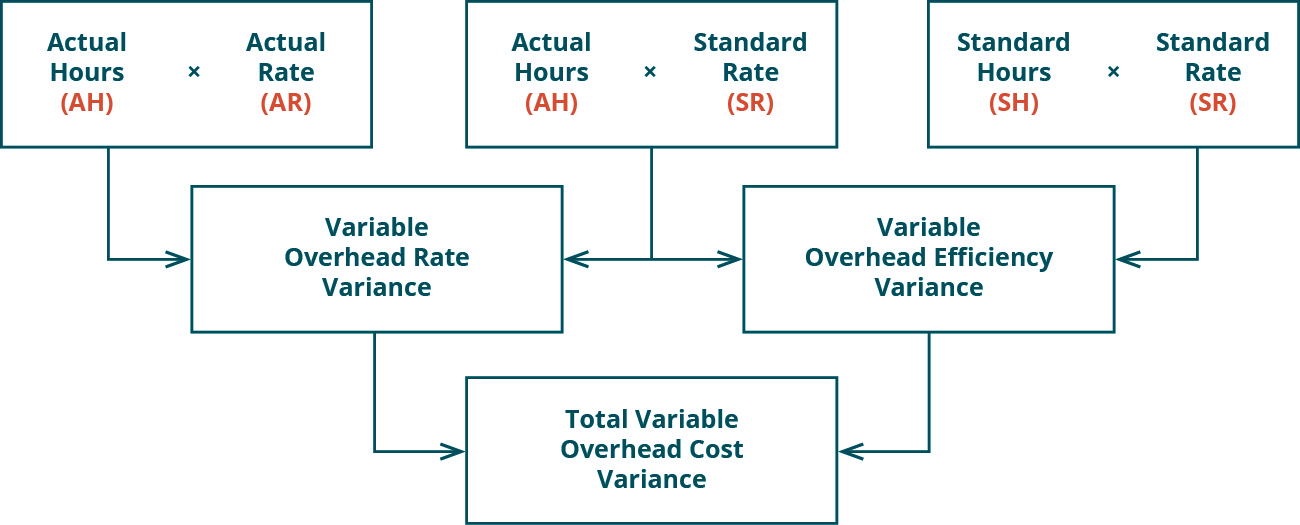

These variances are generally split into two broad categories. And overhead variances presented as both formulas and tree diagrams. To calculate the overhead rate divide the indirect costs by the direct costs and multiply by 100.

600 Adverse ii Fixed Overhead Variance. Variable factory overhead may be split into. Fixed overhead however includes a volume variance and a budget variance.

Compute the variable overhead spending and efficiency variances. Compute the fixed overhead spending volume variance. If your overhead rate is 20 it means the business spends 20 of its revenue on producing a good or providing services.

Many companies produce variance reports and the management responsible for the variances must explain any variances outside of a certain range. PriceRate Variances or differences between industry standard costs and actual pricing for materials. If the basis of allocation does not appear correct for certain types of overhead costs it may make more sense to split the overhead into two or more overhead cost pools and allocate each cost pool using a different basis of allocation.

The rent for your bakery is the same amount every month. Compute price and usage variances for direct materials. Companies use variance analysis in different ways.

In this case two elements are contributing to the favorable outcome. There are three types of overhead. Percentage on direct material cost.

Lets examine the first three in more detail. VFOH efficiency variance Actual hours -. VFOH Spending Variance and VFOH Efficiency Variance.

When calculating for variances the simplest way is to. Companies use variance analysis in different ways. As mentioned above materials labor and variable overhead consist of price and quantityefficiency variances.

The Column Method for Variance Analysis. The variable overhead spending variance is the difference between the actual and budgeted rates of spending on variable overhead. VFOH spending variance Actual rate - Standard rate x Actual hours.

Ute the fixed overhead spending and volume variances. Note that for some of the. I Variable Overhead Variance.

Standard Mix of Actual Quantity x Standard Price. We have 1300000 in applied overhead currently sitting in the three accounts. The starting point is the determination of standards against which to compare actual results.

The three-way analysis computes three variances spending efficiency and volume variances. Efficiency Variances and Quantity Variances or differences between actual input values and the input amounts specified. Materials Labor and Variable Overhead Variances which include.

There are a number of ways to calculate overhead absorption rate based on the numbers you need for your business including. The result is an overhead rate of 1000 per machine hour. Actual annual overhead costs totaled 800000 of which 294700 is fixed overhead.

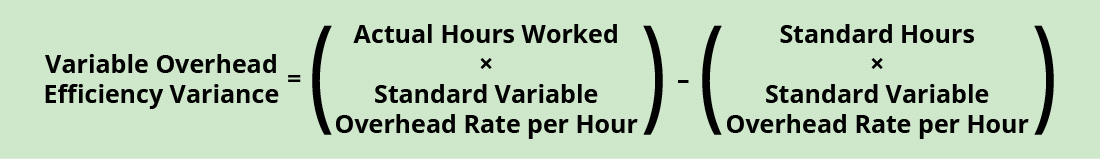

The variance is used to focus attention on those overhead costs that vary from expectations. The measures used to calculate overhead rate include machine hours or labor costs with these costs used to determine how much indirect overhead is spent to produce products or services. The variable overhead efficiency variance is calculated as 1800 200 2000 200 400 or 400 favorable.

Compute And Evaluate Overhead Variances Principles Of Accounting Volume 2 Managerial Accounting

Compute And Evaluate Overhead Variances Principles Of Accounting Volume 2 Managerial Accounting

Compute And Evaluate Overhead Variances Principles Of Accounting Volume 2 Managerial Accounting

0 Comments